Take a look at the picture on your right, make a guess on which of the two lines is longer!

You may want to measure it with a ruler to confirm that both the lines are of the same length!! Not all illusions are visual, we take a look at how some of such illusions lead us to take some financial decisions that we do. But before that let us understand the two systems that lead us to take decisions.

TWO SYSTEMS

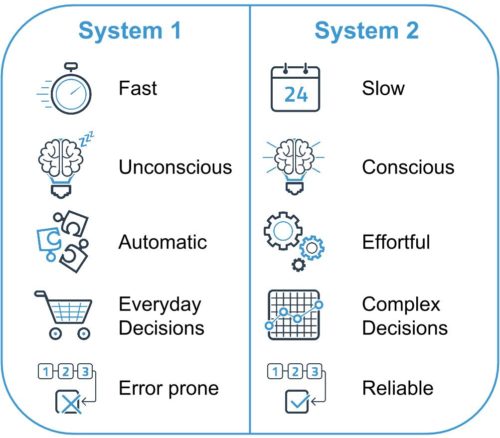

SYSTEM 1 operates automatically and quickly, with little or no effort and no sense of voluntary control

SYSTEM 2 allocates attention to the effortful mental activities be it complex decisions, numerical calculations, the conscious reasoning self that has beliefs, makes choices, and decides what to think about and what to do.

While the Rabbit (SYSTEM 1) will provoke us to take quick, easy, default decision, but the Hare (SYSTEM 2) will provoke us to be logical, analytical and take a step back before taking any decision.

It’s interesting how we can draw an analogy to some of the investment decisions we have been making and continue to make.

Automated Investment Decisions

Savings Deposit

Most preferred mode of saving and keeping idle short term money is through savings deposit. This is an auto mode of keeping money .

Fixed Deposit

A preferred alternate to Savings deposit is Fixed Deposit due to higher returns. The returns are taxable and the interest rates have been declining steadily over the past 2 decades.

PPF

Public Provident Fund (PPF) is a popular tax saving plan which offers tax benefit and government backing making, but as highlighted in our previous article (PPF VS ELSS) for a 15 year investment horizon, one may want to explore other alternates depending upon the risk appetite.

Insurance-Investment Plan

A mix of insurance and investment are the most popular form of insurance plans popularized by a large public sector insurance company. They are bought by people looking for Insurance without cGost or think that Insurance is a cost and should be bundled with investment only!

Gold

One of the most favored investment of the Indians has been Gold due to a host of reasons, primarily because its a legacy investment, passed on from generations to the next one. But few would agree that the returns of gold has been in line with fixed deposit returns over the past 30 years, ! (Gold, Fixed Deposits & Equities- Making the Right Choice)

Effortful Investment Decisions

Liquid Funds

These are short term mutual funds ideal for less than a year period. This is an alternate to savings deposit offers far better returns though not guaranteed. Now the risk reward for this investment is so favorable yet not many people explored this alternate.

Term Insurance

A classic example of the system 2 agnostic investor decision behavior is prevalent in Life Insurance the most. Life Insurance for practical purposes is a form of protection, transfer of FINANCIAL RISK. As per Wikipedia

“Insurance is a means of protection from financial loss. It is a form of risk management primarily used to hedge against the risk of a contingent, uncertain loss.”

As MINT newspaper points, PERSISTENCY RATIO, which measures how long customers stay with their policies by considering the premium renewals throws a very bleak picture

According to figures of financial year 2015, as reported by the insurance regulator in its handbook of statistics, the industry, on an average, reported a persistency of 59% in the 13th month. In other words, out of 100, just 59 policies got renewed. In fact, the average persistency for the 61st month is about 22%, which means by the end of the fifth year, only 22 policies got renewed.

Debt Funds

A not so complex investment product perceived complex as the returns aren’t guaranteed but look at the past tax adjusted returns one would be surprised that the risk is not with the product but more so in lack of understanding the nature of the product. Unlike Equity Mutual Funds, which invests in Equities and have a longer term horizon for investment, debt funds are of various types and offers excellent avenues for returns for anyone looking to deploy money for short to medium term.

Equity Funds

Historically, one of the best asset class (Gold, Fixed Deposits & Equities- Making the Right Choice) with returns far superior to any other investment. Also the only investment which, if held over a one year period attracts NIL TAX. Ideally, this should have been a part of a majority of an investor’s portfolio! Till January 2016 the total number of investors in India stood at 4.58 crores so about 4% of the population! So clearly the risk return matrix is not understood by a majority.

Our basic premise of this article was to share some interesting behavioral aspect which I come across when investors were being naïve about their Investment decisions. What has worked for a generation earlier became their default investment behavior too! One may have the risk appetite to invest in slightly riskier return and while some may not, its time to check that and JOIN OUR CIRCLE.

JOIN OUR CIRCLE

Your circle comprises of the people you trust and turn to for advice. It is that sense, your home. At Equest Capital, we take this circle of trust very seriously and are fully committed to everyone who join ours. Giving you advice that serves your need instead of selling a product is just one of the many ways we honour this responsibilty.