Owning equities is about living in regret for 94 percent of the time – a strong reason for getting paid an extra reward called equity risk premium.

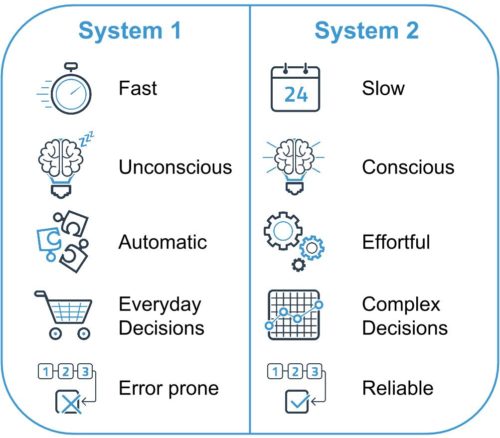

Most market participants conflate risk with beta and volatility. Risk is neither. Risk is about drawdown, it is about loss of capital. When one looks at the drawdown of the BSE Sensex over three-and-a-half decades, it is evident why equity investors earn a premium return over bond investors and other categories of investments.

Indeed, for an investor in the Sensex, 94 percent of the past three and a half decades has been spent in regret – that is, at prices lower than the trailing high. Compare that with a fixed deposit, for which an investor spends zero percent of his time in regret, since the subsequent values are always higher than the previous day’s value (except in the event of a bank blow-up – a very rare event in India).

In fact, Sensex data shows that 57 percent of the time investors have the pain of experiencing at least a 10 percent loss, and 34 percent of the time that of a 20 percent loss (read that again: one in three days of an investor’s holding period).

The drawdown of the Sensex plots a Pareto distribution and explains why equity investors need to be compensated for their investments – they bear a lot of pain most of the time.

As we know, this excess return that equities earn is known as equity risk premium. Why should equities earn an excess return? What is so special about equities? Is it because equities tend to be more volatile than bonds and other asset classes, or is it because equities are a junior claim on the company’s cash flows and assets and therefore more risky in nature. Well, it is all of these factors.

This regret means that it takes a special quality to be an equity investor. It means that only a minority of the world’s population (or more specifically in the current case, India’s population) dares or cares to own equities. The rarity of an equity investor, as a result of the enormous regret or pain involved in owning stocks, is the key reason equities generate excess returns, i.e., equity risk premium.

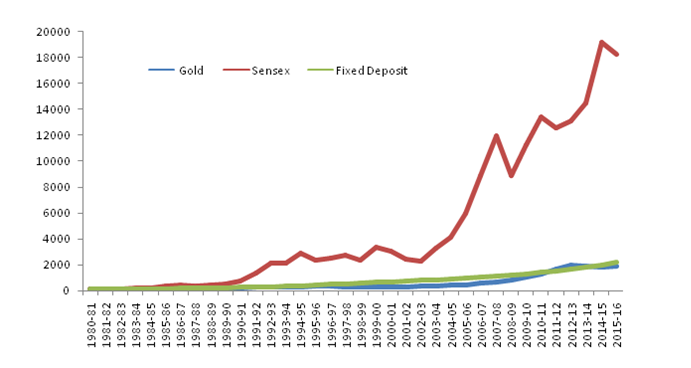

Let us explain this using the BSE Sensex as a proxy for equity investment. If one goes back three-and-a-half decades, the BSE Sensex has compounded at an astonishing pace of 16 percent annually. However, this compounded annual rate of return hides some sinister stuff – 94 percent of the time the index has been lower than its preceding high; 57 percent of the time the index has been 10 percent lower than its preceding high; and 34 percent, or one in three days, it has been 20 percent or more lower than the preceding high. The average and median drawdowns are 17 percent and 13 percent respectively. These are important numbers. The psychological impact is massive.

The thought that I could have waited to purchase shares, that I bought them in a hurry, produces enormous stress for the equity holder. This stress generally drives away existing and potential investors.

Realised Equity Risk Premium As A Timing Tool

The premium that equity investors earn over bonds does not plot a horizontal line, that is, it is not a constant. It varies with investor sentiment towards both asset classes. The underlying mean reverting characteristic makes realised equity risk premium (ERP) a useful timing tool. The danger of mean reverting variables is that the precise moment of mean reversion is never known, so the utility of implied ERP as a timing tool is only available to genuinely non-levered long-term investors. In the environment we are in today, even the ardent equity investor is giving up relative to long bonds. We cannot predict the moment of mean reversion, but we can say that the long-term equity investor is probably poised for better-than-average excess returns over long bonds in the coming years from the current starting point.

Ridham Desai is managing director at Morgan Stanley India and also serves as head of equity research and India equity strategist.

The views expressed here are those of the author’s and do not necessarily represent the views of BloombergQuint or its editorial team.

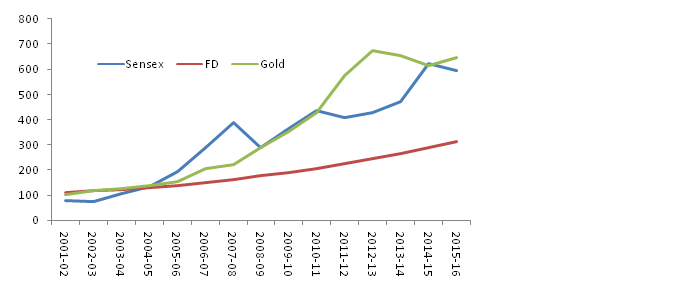

As the saying goes, equity investing is not for the weak-hearted. Why would one say that when it is clear from a slew of data that equities have been the best-performing asset class over long time frames, at least in India? Equities have beaten real estate, treasuries, and fixed deposits quite nicely over 10 and 20 years.

As the saying goes, equity investing is not for the weak-hearted. Why would one say that when it is clear from a slew of data that equities have been the best-performing asset class over long time frames, at least in India? Equities have beaten real estate, treasuries, and fixed deposits quite nicely over 10 and 20 years.

![CropperCapture[3]](http://equestcapital.com/wp-content/uploads/2016/10/CropperCapture3.jpg)

![CropperCapture[4]](http://equestcapital.com/wp-content/uploads/2016/10/CropperCapture4.jpg)