The phrase ‘financial success’ or for that matter any phrase with ‘financial’ as prefix gives an impression of being highly complex. Most people consider it will involve a lot of calculating and analysis and get put off by the very thought.

But look closely and all that poor word means is ‘to do with finances’; in other words, to do with money, in this case, your money. Something you use every day from the time you pull into a petrol pump before your morning ride to work to the time you use your credit card to pay for dinner.

Add ‘success’ in this mix and all the phrase really means is how to win with your money. Now how can that be such a bad thing?

Moving on to the 5 steps, I could do a similar deconstruction of Goal Assessment, Networth Assessment, Need Gap Analysis, Planning & Implementation, and Review. But instead, let’s do something more fun. Let’s plan my niece’s 5th birthday party which falls in a year.

So let’s start by penning down some specifics – how many people are to be invited, what kind of food will be served, what kind of venue do I want and how much will all of this cost me in a year. How these details will help is that they will ensure I can put together the best surprise party for my niece. You do the same thing for your life plans with a financial planner, and it’s called Goal Assessment.

Next, comes figuring out what all I have around the house to plan my party. So I go around and look through last year’s supplies and find that I have some 50 party hats and 25 party favours. I also have a holiday home not far from the city which can be my venue. In the financial world when you make a comprehensive list of everything you own it’s called Assessing your Networth.

Next, comes a fun step, I take my two lists of everything I want to get done for this party and everything I have in terms of resources for it, and I check where I’m falling short. I have 80 guests and 50 party hats for instance; so I need to provision for 30 more. I also need 55 party favours, a catering service, princess theme decor and cake. All this put together will cost Rs. 35,000 in about a year but my brother only has Rs. 30,000 to spend, so I am looking at a shortfall of Rs. 5000. My financial planner calls this step the Need Gap Analysis.

Now to plan for my shortfall, I call up my friend and financial planner and tell him to invest this money for me in such a way that I will have Rs. 35,000 in one year. This he calls Financial Planning and Investment.

In one year, I get Rs. 35,000 and am able to plan a beautiful surprise party for my niece. My financial planner is also invited and over cake and coffee, we discuss the next big surprise party for her 10th birthday, and he suggests a plan for it. In other words, he does a Review, and we start over right from Step 1. Now that wasn’t so complicated, was it? In fact only logical.

And while I took a fairly short term goal as an example and one that doesn’t cost too much; The principle pretty much remains the same – not matter how large your goals or how varied. If the idea of putting your life out on the table still worries you, start simple – not with a birthday party but maybe an expensive vacation or the house of your dreams. Sit with your financial planner and do the same exercise for yourself and if at any point you start getting bogged down by obscure financial terms think of your life as one big party and then get party planning.

Read more about starting your financial planning journey here.

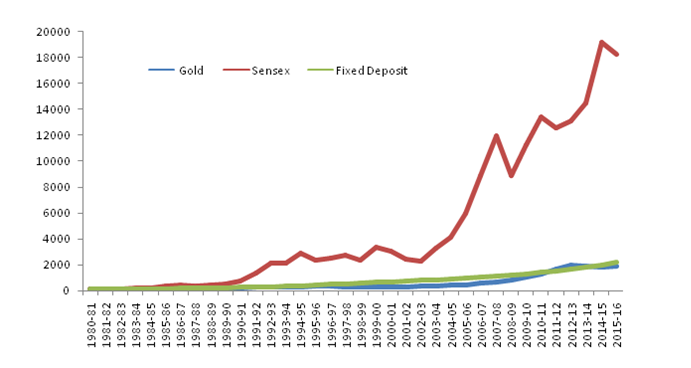

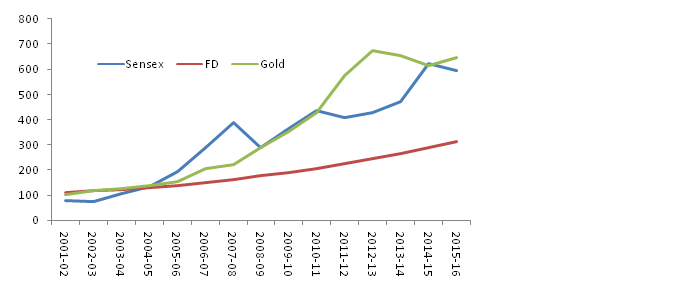

As the saying goes, equity investing is not for the weak-hearted. Why would one say that when it is clear from a slew of data that equities have been the best-performing asset class over long time frames, at least in India? Equities have beaten real estate, treasuries, and fixed deposits quite nicely over 10 and 20 years.

As the saying goes, equity investing is not for the weak-hearted. Why would one say that when it is clear from a slew of data that equities have been the best-performing asset class over long time frames, at least in India? Equities have beaten real estate, treasuries, and fixed deposits quite nicely over 10 and 20 years.

![CropperCapture[3]](http://equestcapital.com/wp-content/uploads/2016/10/CropperCapture3.jpg)

![CropperCapture[4]](http://equestcapital.com/wp-content/uploads/2016/10/CropperCapture4.jpg)